To quit right now might seem to be the absolute worst thing to do.

Yet for one reader, this has been something he has been contemplating for a few weeks.

I told a lot of people it will be pure suicidal to come and ask someone who spent most of his time at the lower end of the totem pole than someone close to the top.

Yet, my reader wishes to try his luck to see whether I was plagued with this dilemma in the past and how I got round this. To be fair, his initial idea was to ask me about the money side of things.

Managing People with Aggressive Attitudes

My reader works as a product manager in the FMCG industry. His work involves managing and coordinating the development of physical products such as injection molding, assembly line, packing, and shipping.

Recently, he just felt very stress at work. It got to a point where he wonders whether it is a good idea to quit.

He felt that there is not a lot of future in this field as he sees that people can easily come in and pickup quite easily what he does if he decides to quit.

He is working most weekends right now writing documents that he thinks he should not be writing, coordinating over the smallest of tasks.

In the past 6 to 8 weeks, the work load has increase for him substantially.

One of the frustrating things for him was that there has been a turnover of team members and let us just say that his new team members are… more aggressive people and difficult to manage.

If he quits now, there is no job lined up. Prior to Covid-19, he was still getting some offers from small, tech startup.

If you read enough of Investment Moats, sometimes you will be poisoned enough to ask what are the possibilities of your wealth and whether it enables to you quit and be financially independent in some ways.

And this is what he consulted me about.

Think About the Levers That You Can Pull At Work

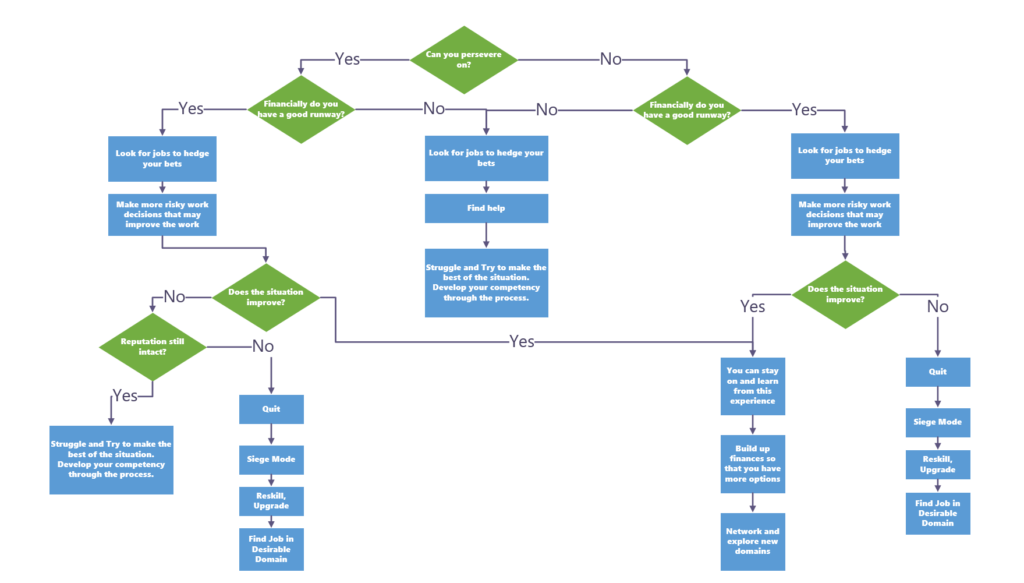

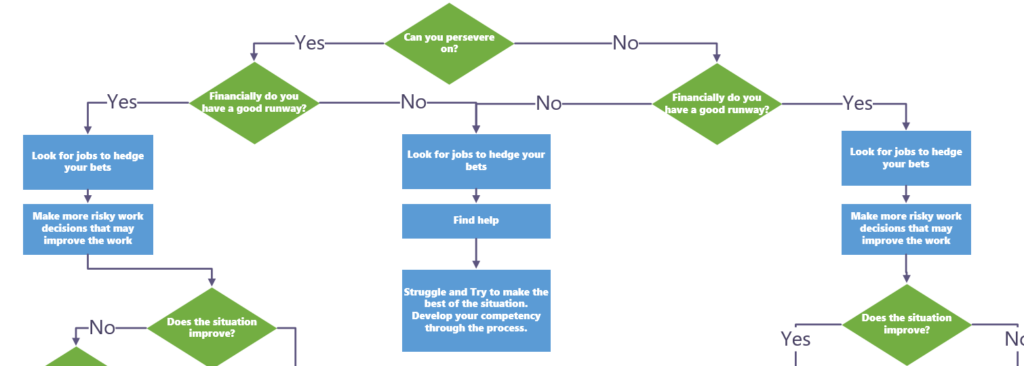

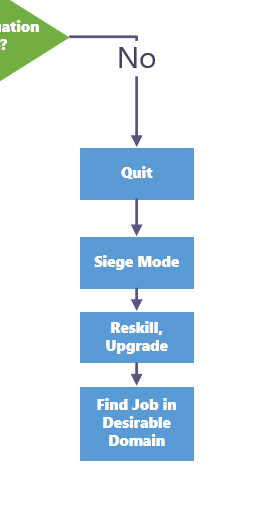

This is how I would model this problem:

It is a little small so you may need to expand it.

While my reader asked me about the money aspect of the decision, I think in many cases, the top determining factors tend to be his situation at work.

In my reader’s case, a lot will rest upon his threshold of tolerance at work. That will determine the course of action he should take.

In his case, I felt that there is a lot of pent up frustration that are collected, and in recent weeks, the amount of frustrations collected short up.

There are times that you could see some light and work through these work frustrations but there are other times that it would be better to have a fresh start.

The interesting situation is that currently, it might not be the best time to quit due to the labor supply and demand dynamics.

The Health of Your Finances May Determines Your Course of Action… To a Certain Extent

Whether he can presevere on or not, having a healthy wealth situation will affect his decision making.

If he is not in a very financially healthy position, the in both cases his response would be to

- Start looking for jobs, just to get away from this “toxic environment”

- If he is struggling with certain aspect of the work, look to see if any peers or if he is in a good organisation, whether there are some mentors he could talk to, so as to manage the situation better

- If not, he would have to struggle to get better and endure.

Options are limited and if he were to quit now, the risks is even higher.

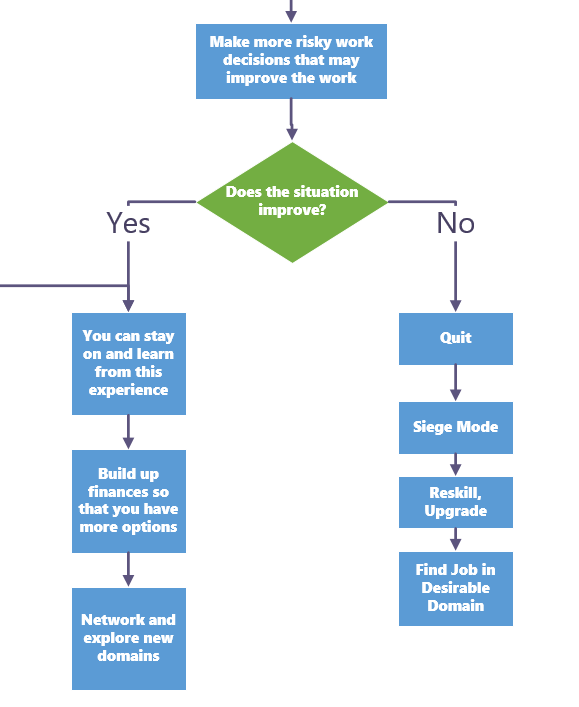

However, if financially he more healthy, it would be prudent for him to continuoe to look for jobs. The difference is that he could make more bold decisions, that may potentially blow up.

He could better afford to do that because if he cannot persevere and he is financially healthy, those bold actions might result in him improving his managerial competency, or change the working environment.

In both cases, it would give him a more livable work environment. He can then wait until the timing is better before moving on.

It also gives him possibly 4 more years to reach a better financial position, where his wealth machine produces a wealth cash flow that covers a larger portion of his survival expenses for 50 to 60 years.

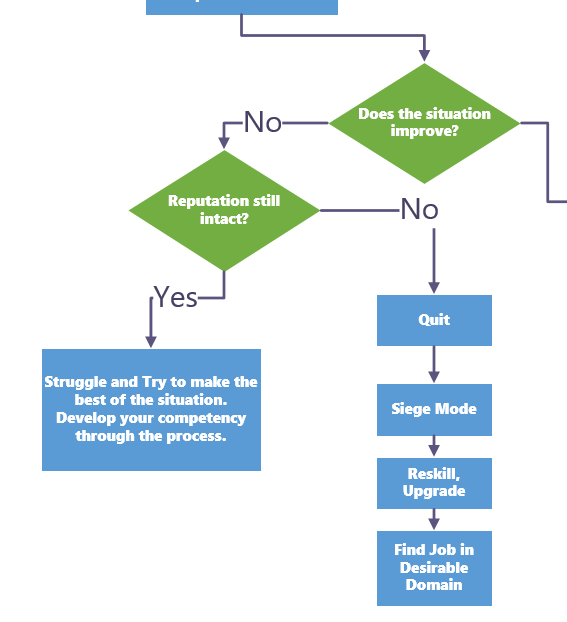

Even if he can endure, some of the bold moves might potentially make his position untenable.

In this case, it is still a livable consequence because his original idea was to quit. In a few of these paths, you would realize at least he gave it a try before quiting.

If his reputation and working relationship is still amicable, it will depend whether he can continue to endure. If he could not, he will go to the right side of the entire decision tree and if he could, he can continue to struggle.

What is Considered Financially Healthy?

My reader initially wanted to explore whether his cash flow from his portfolio is enough for him to call it quits.

I explained to him that instead of thinking whether his portfolio, at X% dividend yield, is able to give him $Y, which is enough for his annual expense, queue up all his wealth and see how long of a runway he has before his situation becomes dire.

For example, he explain that to maintain his current lifestyle, he can work with $1,500 a month.

Perhaps for survival, he can work with $1,000 a month. That is $12,000 a year.

If he adds up all his assets, less his liabilities, he will get his net wealth.

Arrange them in order of liquidity, with cash in front, and the next liquid assets next. Calculate the amount.

I suspect that he has enough that is closer to $120,000.

That gives him a runway of 120 months or 12 years. Sure, this expense is not inflation-adjusted, that that is a quick and dirty way of figuring out how long of a runway he has.

Knowing you have 10 to 12 years of runway to get the next job, or get a career in a new domain kickstarted.

The alternative is to determine the amount of cash flow he can withdraw, yet keep his net wealth from severely depleted.

I have 2 suggestion.

The first suggestion is to determine the cash flow he can take out and he would likely not deplete his net wealth for 50-60 years. That will be to withdraw 3% for the initial year.

Assuming he has $120,000, that means he will withdraw $3,600 to spend a year. That will probably last him for 3 months.

The second suggestion is to be more rational. We know that my reader is too young and will earn income next time. This is just possibly a 1-year stopgap.

We can be bold to allow him to spend 5-8% of his net wealth. He would eventually replenish his net wealth from his work next time. That will bring him about $6,000 to $9,600 a year.

As you can see, framing the utility of my reader’s wealth in terms of a perpetual wealth machine can be rather challenging.

I think for most people, there are

- a phase where their net wealth is more useful as a long runway for transition and

- in the next phase, their net wealth has the potential to give them financial independence.

Had my reader said his net wealth is close to $300,000, with his essential expenses at $12,000 a year, I would say he has a relatively high chance he can take a longer sabbatical from work.

But make no mistake, if he has $120,000, he is in a wildly good financial situation to make a more risky, calculated decisions.

The Playbook if He Quits

The way I laid out the decision tree is to buy enough time to start looking for jobs even before he quits.

If it ends up with him deciding the better choice is to quit, then the first thing is to get into siege mode in terms of expenses and course of action.

My article on What You Should Do if You Lost Your Job or Lost Your Income Temporarily is a must-read.

For my reader, he probably has enough run way of 10 months to 1 year to reskill into a new domain or find a job in his current domain.

A Part-time Job May Alleviate the Expenses

The labour demand and supply dynamics makes this suggestion a bit challenging.

But I am trying to be open-minded that my reader have some unique talents that he could do some work in an industry that has not been pulverized by Covid-19.

If he is able to, it will drastically lengthen his runway, while maybe give him enough bandwidth to retool or find the next job.

Is it Normal to Feel His Frustrations?

Sometimes you do not know whether it is unique to feel this form of frustration.

I do not have enough experience to say I know this well, but I do tend to think that work frustrations just translates to one form or another.

If he gets to another job, the work dynamics may mean that stress is felt in a different form. Another aspect of his job may become frustrating.

It seldom goes away.

But of course you could work in a place in a scope that has very little things that frustrate you.

When I join the new firm 1 year ago, I experienced this first hand that what was stress in the past gets alleviated but replaced by stress in other areas.

Another Job Might Not be An Improvement Over the Current Job

There are two kinds of job that awaits.

The first one is a new role created due to the demands of the customers. These jobs tend to be growth based.

The second one is an existing role that is available because someone leaves.

The stresses in both are different.

The second one tends to be a mixed bag. If someone left because she found a better offer then this job might be okay.

However, a lot of times, people leaves a job because it is either hard, too stressful, or the culture is too toxic.

And if you get in, you jump into it. It may make you wonder if you make the right decision.

Based on some of the things shared, I felt that if he goes into another place, he would experienced the same thing.

The Biggest Worry on My Mind

If you ask me, what is tougher: portfolio allocation advise or career advise, in this case I would say the career one.

At this point his human capital potential is much larger and if we jeopardize that, the impact will be far larger.

I felt that the insecurity we have here is whether it is career suicide to quit now, take too long of a break and end up being damaged goods.

On one end, employers might be aware that there will be a lot of people looking for a job or are without a job during this period.

If he emerges from this period without a job, or if he shows on his resume some conscientiousness to upskill and do some jobs to improve his situation, this might not be so bad.

Is the Product Manager or Project Manager Role a Fading Career?

My reader felt that there isn’t a lot of value in a project coordinator, manager or product manager role.

Perhaps his experience learning programming have exposed him to what is considered of value.

I am not sure if the industry have passed so much but I do think there will be some one looking for a competent coordinator or project manager.

Another person could replace you, but could the person do as well as you?

There will always be something that needs to be managed, so I find it interesting he holds the view that this may be a dying trade.

If these are fading careers, then I fear for a lot of my ex-colleagues. My fellow readers could educate me here whether he is right.

I got a feeling it is not.

But to do well in this role, it does need to come with a skillset that is a mixture of

- A good planner

- Good EQ and good communicator

- Be willing to actively work with stakeholders

- Good critical thinking

- Adequate knowledge of the domain that you are managing

Conclusion

Whenever we have an ex-colleague leave us, I never could ask him or her whether leaving the company was the best decision.

I would think that to save face, most of us would say that leaving has a lot of pros, outweighing the cons.

I been fortunate that I did not have to fight in that environment before, so my default answer to the reader would be can you endure and make the best out of the situation.

His portfolio has not reached the size where it is able to provide consistent, recurring income that covers his needs. The portfolio could cover part of the essential expenses and that is a pretty good situation.

However, if we frame it as a personal, temporary social security program, then it is very functional.

What goes through my mind is that everyone needs to work on a second possible human capital alternative in their lives. And this is probably something that I will write about in the future.

A second possible human capital alternative is not having a passive stream of income from your wealth machine or something. Building on a wealth machine needs to be a consistent, ongoing process.

That is more like developing a skillset to an extent that if the first one does not work out, you have a second career that you can move into. For example, some of us have the interest in cooking, but we only cook so that the skill fed ourselves. However, there are some that was able to deepen their skills that the quality of food they prepared may be in demand.

Something along that lines.

Anyway, that does not solve the current issue.

If you have some good views about my reader’s situation, or you have an opening in something similar, do let me know.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post Should I Quit a Tough Job in the Middle of a Pandemic? | Reader Question appeared first on TinySG.

from TinySG https://tinysg.com/should-i-quit-a-tough-job-in-the-middle-of-a-pandemic-reader-question/?utm_source=rss&utm_medium=rss&utm_campaign=should-i-quit-a-tough-job-in-the-middle-of-a-pandemic-reader-question

No comments:

Post a Comment