Here is a safe way to save your money that you have no idea when you will need to use it, or your emergency fund.

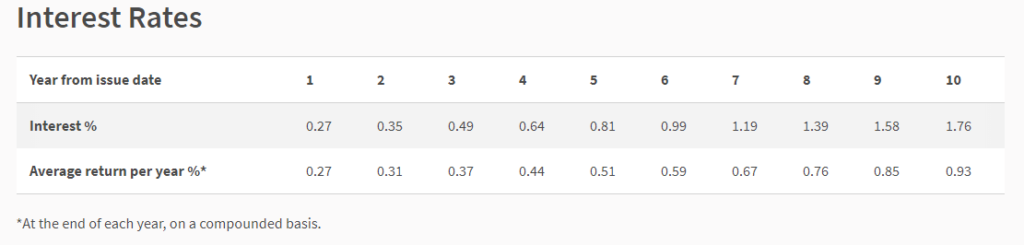

The August 2020’s SSB bonds yield an interest rate of 0.93%/yr for the next 10 years. You can apply through ATM or Internet Banking via the three banks (UOB,OCBC, DBS)

However, if you only hold the SSB bonds for 1 year, with 2 semi-annual payments, your interest rate is 0.27%/yr.

$10,000 will grow to $10,946 in 10 years.

This bond is backed by the Singapore Government and its available to Singaporeans.

A single person can own not more than SG$200,000 worth of Singapore Savings Bonds. You can also use your Supplementary Retirement Scheme (SRS) account to purchase.

You can find out more information about the SSB here.

Note that every month, there will be a new issue you can subscribe to via ATM. The 1 to 10-year yield you will get will differ from this month’s ladder as shown above.

Last month’s bond yields 0.80%/yr for 10 years and 0.30%/yr for 1 year.

Here is the current historical SSB 10 Year Yield Curve with the 1 Year Yield Curve since Oct 2015 when SSB was started (Click on the chart, move over the line to see the actual yield for that month):

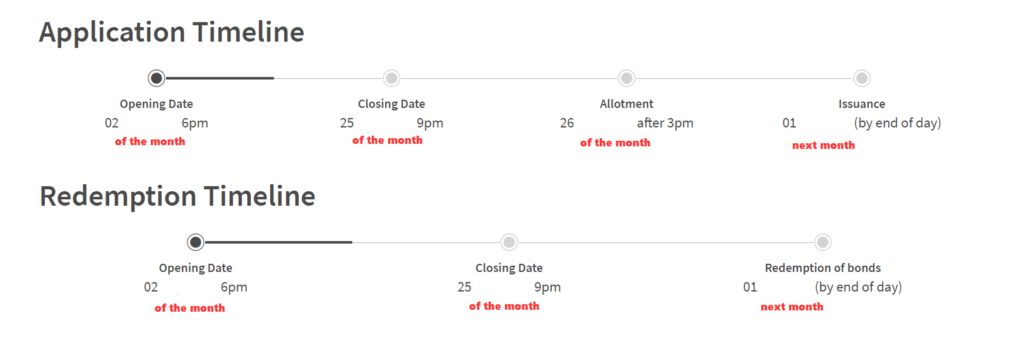

The Application and Redemption Schedule

You will apply for the bonds through the month. At the end of the month, you will know how much of the bond you applied was successful.

Here is the schedule for application and redemption if you wish to sell:

You have 02 to about 25th of the month (technically the 4th day from the last working day of the month) to apply or decide to redeem the SSB that you wish to redeem.

Your bond will be in your CDP on the 1st of the next month. You will see your cash in your bank account linked to your CDP account on the 1st of next month.

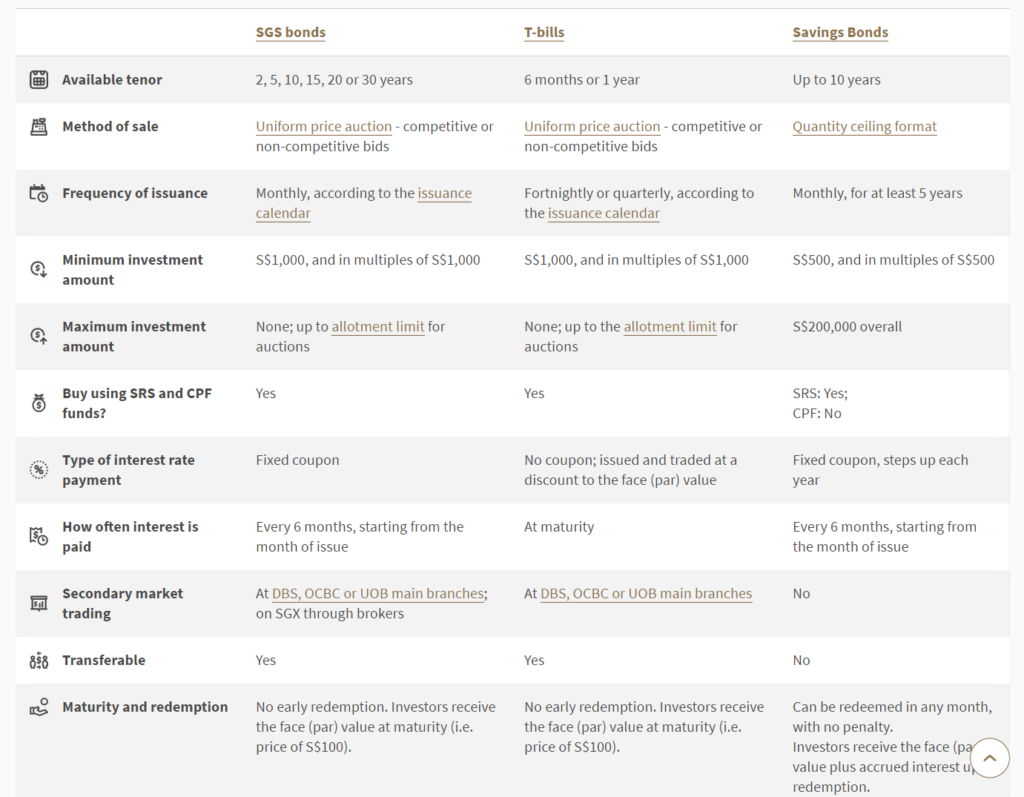

How does the Singapore Savings Bonds Compare versus SGS Bonds versus Singapore Treasury Bills?

Singapore savings bonds is like a “unit trust” or a “fund” of SGS Bonds.

But what is the difference between you buying SGS Bonds and its sister the T-Bills directly?

Both the SGS Bonds and T-Bills are also issued by the Government and are AAA rated.

Here is an MAS detailed comparison of the three:

What is this Singapore Savings Bonds? Read my past write-ups:

- This Singapore Savings Bonds: Liquidity, Higher Returns and Government Backing. Dream?

- More details of the Singapore Savings Bond. Looks like my Emergency Funds now

- Singapore Savings Bonds Max Holding Limit is $200,000 for now. Apply via DBS, OCBC, UOB ATM

- Singapore Savings Bonds’ Inflation Protection Abilities

- Some instructions on how to apply for the Singapore Savings Bonds

Past Issues of SSB and their Rates:

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post Singapore Savings Bonds SSB August 2020 Issue Yields 0.93% for 10 Year and 0.27% for 1 Year appeared first on TinySG.

from TinySG https://tinysg.com/singapore-savings-bonds-ssb-august-2020-issue-yields-0-93-for-10-year-and-0-27-for-1-year/?utm_source=rss&utm_medium=rss&utm_campaign=singapore-savings-bonds-ssb-august-2020-issue-yields-0-93-for-10-year-and-0-27-for-1-year

No comments:

Post a Comment