When the market took a ferocious plunge this March, I wrote an article titled Retiring into a 2020 Bear Market. The first three months.

One of my readers came away with a question that I thought I will spend sometime to address. (If you write in to me and I do not reply to you, it is not that I am ignoring you but that my mail box is pretty jammed up)

So my reader would like to know my take if a prospective retiree setup their retirement this way:

Suppose he has accumulated $1 million dollars. He will deploy his capital this way:

- $500,000 is invested in reits and high dividend stocks. Let’s say he expects that they generate a 6% dividend yield. This will give him a dividend income of $30,000 a year but he expects the dividend to drop.

- $500,000 is invested in bonds, fixed deposits, and cash instruments. This will give him an interest income yield of 2% a year, which will give him an income of $10,000 a year.

- He expects that his annual spending is drawn from the reits and stocks dividend first. If that is not sufficient, the rest will be drawn from #2.

- He wishes to be very disciplined to ensure that the maximum he spent every year can only be drawn from #1 and #2.

How long would it be before he runs out of money?

What are the pitfalls and blindspots? Strength, weakness?

How long would it be before $1 million dollars runs out for retiree?

This reader did not provide some vital information:

- Will he adjust this income requirement for inflation? I would assume he would

- From what he says, he wishes to be flexible about his spending. If he cannot be flexible with his spending then that is another permutation

- REITs and high dividend stocks in which market?

Based on the data that I have read, the long term returns of REITs are pretty similar to the broad-based equity index in the US. So I can use the S&P500 as a simulation. For the past 90 plus years, the compounded growth of the S&P 500 is 9.5% a year.

For the bonds and cash, I would use the 1-Month US Treasury Bills as a proxy. For the past 90 plus years, the compounded growth of the 1 month treasury bills is 3.3% a year.

From what he says he will withdraw an initial income of $40,000 from this $1,000,000 portfolio.

Let us first assume that we adjust the income every year based on the prevailing inflation rate for the previous year.

I tested whether this reader money can last 30 years.

This setup will last 93% of the time.

In 4 instances, this would not last:

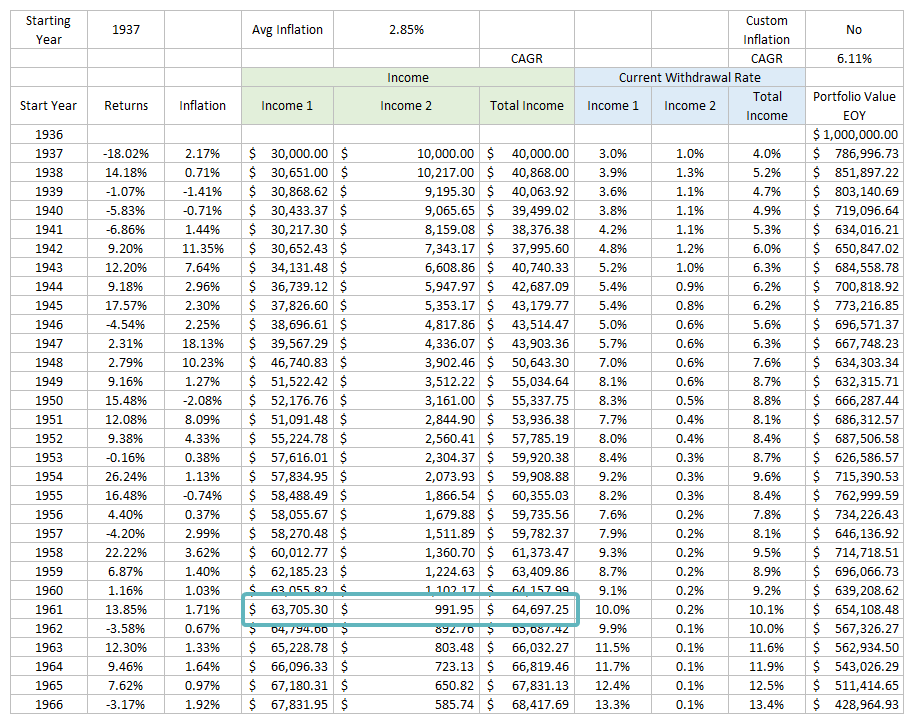

- The 1937 30-year period

- Runs out after 25 years

- Ending income $84,940

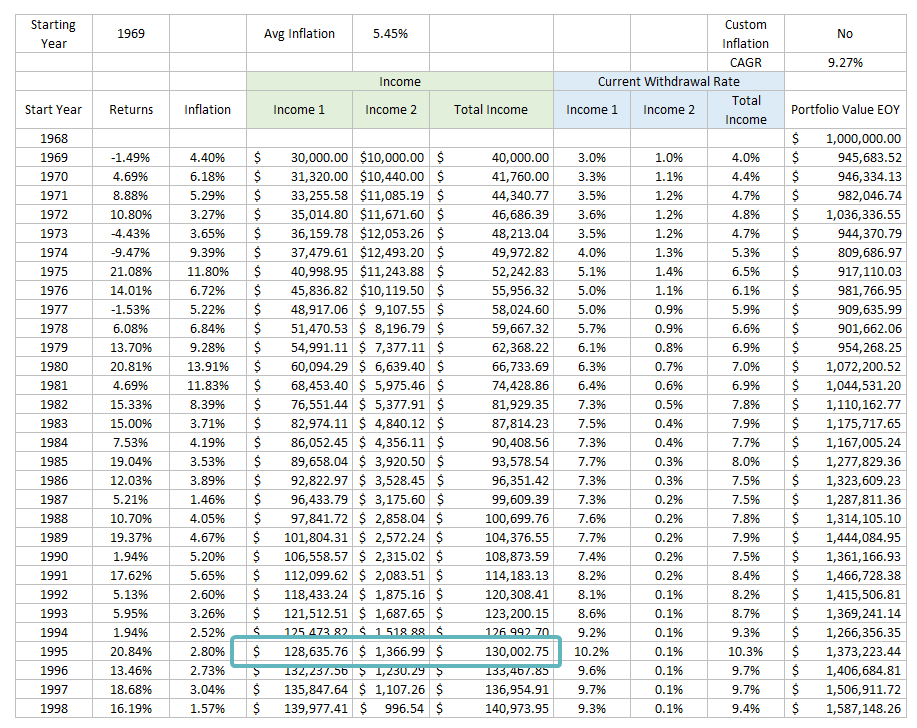

- The 1966, 1968, 1969 30-year period

- Runs out after 27-28 years

- Ending income about $171,514

His income keeps up with inflation.

If Retiree is flexible with $10,000 of his income, how long would his money last?

Now let us simulate the scenario where he draws from his REIT and dividend portfolio, but when his spending is too high relative to his current portfolio value, he choose to tune down the $10,000 of his spending.

This means that

- $30,000 is adjusted for inflation

- $10,000 will not go up or even go down if the portfolio cannot take it

The simulated result is:

- His money lasts for 30 years 100% of the time

- His money lasts for 40 years 99% of the time

- His money last only 71% of the time for 50 years

Let us compare how his 30-year retirement will be like for the tough 1937 and 1969 periods that caused his plan to fail previously:

I do not understand why 1937 to 1966 was so hard versus 1936 and 1938, but that is the intriguing nature of sequence of returns.

Instead of running out of money in 1961, my reader would spend through this period. Instead of spending $84,940, spends only $64,697.

He loses 23% of his purchasing power.

His income is higher than when he starts off though.

Out of his $40,000, the $30,000 is adjusted for inflation, the $10,000 eventually gets wittled down to $0.

It is not deflation that kills retirement. It is high inflation.

The 1960s is brutal because inflation averages above 5%. In this sequence, you will realize that the biggest portfolio drop is only -9.47% in 1974!

Instead of spendingn $171k, he would only spend a total of $130k by 1995. He lost 23% of his purchasing power.

What if he assumes a constant 2% a year inflation?

If he assumes a 2% a year constant inflation, his portfolio cannot last over the 30-year period as well.

There were 4 instances out of the past 61 instances that the reader will run out of money.

These are the years that starts in 1928 to 1931.

The reason: He consistently tries to spend more even though things are getting cheaper.

What if he assumes no inflation adjustment?

There will still be 1 instances out of the past 61 30-year instance where his portfolio will not last.

Why is that so?

The reason is the same. In a deflationary period, things are getting cheaper but you still insist on spending $40,000 a year, the reader is putting pressure on his portfolio.

Wait… These Simulations are not Exactly What He is Asking About!

If you re-read what my reader is asking, you will realize that my simulation is a bit different from what he is asking.

The truth is that… there is no way of simulating that.

But I realize sometimes how unrealistic that is to simulate:

- The dividend income is variable

- If not enough take from interest income up to $10,000

- Not sure if I should adjust for inflation or not. If I were to adjust, then do I adjust the $10,000

I could simulate this with Singapore REIT’s past returns but if you ask me, would you trust the result of 1 set of historical results that is less than 30 years and in a period where REITs have done relatively well?

I do not think so.

The Most Important Consideration Was Not Provided

When you try to conceptualize how much you need to be financially independent and your spending plan, start by thinking also about:

- How much income you need

- Out of all your income requirements, how much are recurring or one time expenses

- Out of all your income requirements, how much are you willing to be flexible and how much you would definitely need to have

This will drive a lot of the planning.

In my article How Much Money do You need to be Financial Independent? A Deep Dive, I covered how to go about planning how much you need. Everyone can start with that. It will give you a sound rule-of-thumb amount.

Spending Dividend Income Before Interest Income

The strength of spending dividend income before interest income is that if dividend income is enough, the interest income builds up.

When dividend income is not enough you can spend on interest income.

This is a bit different from my simulation in that the interest income is not spent at all.

If we go back to my historical simulation, the modification is that my reader is spending $30,000 instead of $40,000 in the initial year.

In that case, his money should last 30 years even if it is inflation adjusted.

I think if you only need $30,000 a year and the interest income is good to have, there is quite a fair bit of buffer.

But if you need all of $40,000 a year for your spending, then based on my simulation, some situations will be a bit challenging.

Future Returns May Not Be Good

Whenever I was asked retirement questions here or at work, I realize everyone is trying to suss out whether they can get a 7% a year return or a 5% a year return.

After looking at so much data, I get abit skeptical about using a certain return rate.

Don’t get me wrong, we definitely need a standard rate of return for planning purpose. If not, it will be quite hard to have a focused wealth accumulation target for the clients and the adviser to have a conversation.

But it would be better to figure out that:

- You have done your best to optimize your income requirement for financial independence

- You have allocated your wealth, based on your risk tolerance into financial investments that are sound and enable you to capture market returns

What you get in the end, you have to pivot.

When my reader was posing this question, he was expecting a conservative fixed deposit income of 2% a year.

If we look at the rates now… how conservative is 2% a year?

The Bloomberg Barclays Aggregate bond index has an average maturity period of 7 years. The bonds are a mixture of government bonds, corporate bonds, treasury bonds.

The yield to maturity is 0.93% last I check.

What we are livng through right now is the period where you do not need to simulate:

- Dividend income being cut for banks and REITs

- Interest income that is below your expectation

- You cannot find work easily because everyone is looking for work and businesses are cutting people than taking in people

If you retire today, what would you do? You might be able to figure out this on your own (but we can have a conversation about this as well if you wish to)

Think in Terms of Total Returns Not Dividend Yield

Lastly, I know that my reader is trying to compartmentalize protecting his capital and spending only his income.

If he does that, his income is going to be variable and he has to be OK with that. (Read Why Living Off Dividend Income in Retirement is Not Perfect)

The toughest picture to swallow is: How do you frame putting 50% of your portfolio or $500,000 in something that yields 0.8% a year?

You would not like that picture a lot.

However, if you think in total return of the bond portion and ask if you could get a 2-4% total return (based on yield and capital appreciation), deploying 50% in bonds may be justifiable.

This goes the same for the equity portion as well.

It Can Be Dangerous to Spend 100% of Your Average Returns Assumption

What do I mean by this?

If you assume the conservative long term returns of the porfolio of REITs and high dividend stocks is 6% and you decide to based your income requirements on 100% of that 6%, it can be rather dangerous.

This is because your returns are not 6%, 6%, 6%, 6%, 6%.

During the years when returns are -15%, and if you continue to spend 6%, that puts more stress on the portfolio.

I have explained in the past a more conservative dividend model. If you assume your conservative dividend yield is 6%, plan with less, say 4% dividend yield.

This buffers the years where your total dividend is lower and yet you can still maintain your lifestyle instead of cutting some expenses that you cannnot cut.

In a sense…. you realize this is like a 6% total return but spending 3% of it. We are back to a withdrawal rate model.

That is all that I can think of.

If you have your own perspective about my reader’s situation, do comment below. As always, he is a fellow reader just like you, so do be as respectful in your tone as possible.

Do Like Me on Facebook. I share some tidbits that is not on the blog post there often. You can also choose to subscribe to my content via email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For the active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

The post How Long Can a $1 Million Portfolio Last if I Spend The Dividend Income before the Interest Income? appeared first on TinySG.

from TinySG https://tinysg.com/how-long-can-a-1-million-portfolio-last-if-i-spend-the-dividend-income-before-the-interest-income/?utm_source=rss&utm_medium=rss&utm_campaign=how-long-can-a-1-million-portfolio-last-if-i-spend-the-dividend-income-before-the-interest-income

No comments:

Post a Comment