Having your own set of wheels provides undeniable conveniences for work, family, and entertainment needs. However, as you’re probably aware by now, car ownership in Singapore is a notoriously expensive endeavour. Besides the cost of the vehicle itself, you’ll also need to pay for gas, insurance, maintenance and, eventually, repairs. These costs can add up to a lot over the years, meaning that your savings (and thus, retirement funds) will take a significant hit. Thankfully, there are ways you can adopt to reduce the costs of car ownership, so you don’t overstretch your finances.

Refinance Your Car Loan at a Lower Interest Rate

Singapore is one of the most expensive places in the world to own a car. For reference, even a modest family sedan can cost upward of S$110,000, which is about 30% the cost of a three-room HDB resale flat. Unsurprisingly, if you’re like most Singaporeans, you wouldn’t have been able to pay for the vehicle in upfront cash. You’d have taken on a car loan instead. If, for some reason, you had to settle on a car loan with an unfavourable interest rate earlier, you might want to inquire about refinancing. Do note that most car loans are priced at around 2% to 3% interest rate per annum. Be sure to do your due diligence and pick one that offers you the lowest interest rate.

Comparing interest rates isn’t the most exciting task, but it’s definitely worthwhile. Even a seemingly small interest rate difference can result in significant savings–especially over a few years. For instance, if you currently have a 5-year, S$70,000 car loan from a bank that is charging a 2.78% interest rate, you will pay S$11,120 in interest over the course of your loan. On the other hand, if you get the same loan from a bank that is offering an interest rate of 2.48%, you will end up paying S$9,920 in interest (or S$1,200 less). Also, there is no advantage in taking a more expensive loan. If you’re overwhelmed by the prospect of having to pore through various banks’ offerings, don’t worry–here’s a comprehensive guide to the car loans available in Singapore.

Drive Moderately & Use Petrol Credit Cards to Save on Petrol

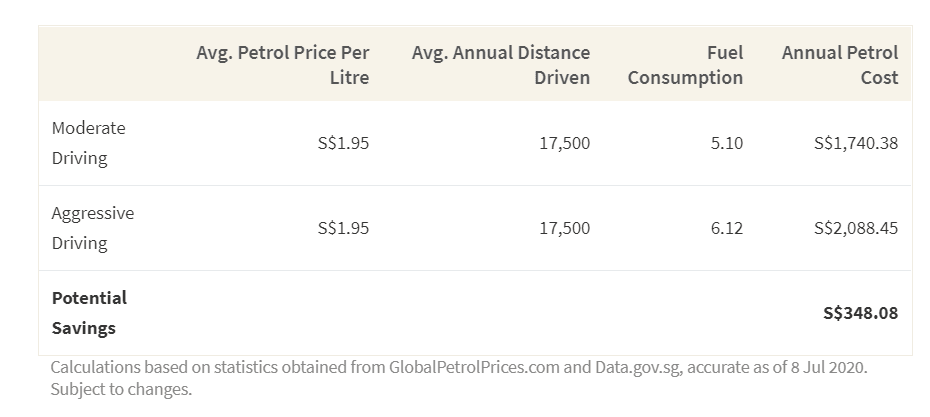

With the average petrol price per litre standing at S$1.95, it’s no secret that the petrol prices here are significantly higher than can be found in neighbouring countries, including Malaysia, Indonesia, and Vietnam. Given that the average annual distance driven per car is 17,500 km, and that the fuel consumption for a Honda Jazz 1.3 is 5.1l/km, the annual petrol cost will come up to S$1,740.38–a sizable amount.

That said, there are ways you can cut down on the money spent on petrol by changing your driving style. Driving moderately, instead of aggressively reduces fuel consumption by over 20%, which directly translates to 20% savings on your fuel costs. This can be done by driving at a slower speed, making softer turns and not slamming on your brakes. You can also make use of petrol credit cards that offer discounts to decrease your monthly expenditure.

Service Your Car Regularly

Generally, it is recommended that you send your car for servicing every 100,000 km or every 5 years. Be sure to do so on time since issues such as clogged engine filters, dirty spark plugs, worn parts, or misaligned wheels can affect fuel consumption adversely. Keeping your car well-serviced is an excellent way to save fuel–and, thus, money. Here’s a tip: Make sure what the mechanics are doing matches the car maker’s requirements. Don’t pay more for unnecessary steps. If you want to be safe, stick with the authorized dealer’s servicing program. Nonetheless, third-party workshops can sometimes be cheaper and faster. The decision between the two depends on your discretion. You can also learn the absolute basics, so you don’t have to pay anytime you need a mechanic to clean the engine, install new spark plugs, or pump air into car tires.

Small Savings Add Up Over Time

As with all forms of personal finance, the more cost-saving measures you adopt now, the more money you’ll save for the future. This is the magic of compounding interest; small savings can amount to large sums over time. Thus, with a purchase as expensive as a car, it’s crucial to save whatever you can. Lastly, it might also be helpful for you to consider renewing your car insurance with a different insurer. In some cases, you can save up to S$500 per year by changing your policy.

The post 3 Easy Ways to Save on Your Car Expenses appeared first on TinySG.

from TinySG https://tinysg.com/3-easy-ways-to-save-on-your-car-expenses/?utm_source=rss&utm_medium=rss&utm_campaign=3-easy-ways-to-save-on-your-car-expenses

No comments:

Post a Comment